A professional website is not a luxury for accounting firms, CPAs, and tax advisors. Your website is your primary revenue driver. Research shows that 70% of potential clients research firms online before making contact, and 94% of first impressions are determined by website design. Yet most accounting websites fail to convert visitors into clients because they neglect the specific psychological, technical, and trust-building elements that matter most in financial services.

This guide reveals what separates high-performing accounting websites from the rest. We’ll examine the competitive landscape, explore industry best practices backed by real case studies, and provide a framework for building websites that attract qualified leads, establish authority, and close business.

We follow an in-depth launch checklist to make sure our website launches go smoothly, if you’re interested in a professional website design and you don’t want to be in DIY hell anymore, get in touch with our team!

1. The Accounting Website Opportunity: Why Design Matters Now More Than Ever

The accounting industry is undergoing a digital transformation. As traditional lead sources—banker referrals, word-of-mouth—decline, the website has become the primary sales tool for forward-thinking firms. In fact, 79% of CPA firm leads now come directly from marketing efforts, with websites generating the majority of these inquiries.

But here’s the tension: while accounting firms invest in websites, most fail to optimize them for conversion. A well-designed accounting website does three critical jobs simultaneously:

- Builds immediate trust through design, messaging, and credibility signals

- Attracts qualified traffic by targeting buyer-intent keywords and local search

- Converts visitors into leads through strategic calls-to-action and friction-free navigation

A firm that accomplishes all three can expect dramatic results. One case study showed a CPA firm increasing organic traffic from 300–500 monthly visitors to 2,000–3,000 visitors per month, with new business revenue reaching nearly $1 million in mostly recurring services.

2. Understanding Your Audience: Who’s Searching for Your Services?

Tax, accounting, and financial services attract visitors across four distinct buyer personas, each with different needs and search behaviors:

2.1 Small Business Owners (Primary Audience)

These are typically first-time business owners seeking strategic accounting support. They search for terms like “CPA for small business owners,” “business accounting services,” and “tax planning for startups.” They value clarity, practical advice, and evidence of results. They’re price-conscious but understand the ROI of good accounting support.

Key pain points:

- Uncertainty about tax liability and deductions

- Time management (accounting takes time away from business growth)

- Fear of making costly financial mistakes

2.2 Specialized Industry Clients

Accountants who specialize (e.g., real estate, healthcare, nonprofits, restaurants) attract a distinct audience searching for niche expertise. These visitors search for terms like “CPA for real estate investors,” “accounting for medical practices,” or “nonprofit audit services.”

Key pain points:

- Need for industry-specific knowledge

- Compliance complexity in their sector

- Desire to work with specialists who “speak their language”

2.3 Individual Tax Filers

Self-employed freelancers, contractors, and gig workers search for “tax preparation for freelancers,” “1099 tax help,” and “self-employed accounting services.”

Key pain points:

- Complexity of self-employment taxes

- Deduction maximization

- Quarterly estimated tax payments

2.4 Enterprise/Corporate Clients

Larger organizations search for CFO services, audit support, and strategic financial consulting. These are high-value, long-term engagements.

Key pain points:

- Complex organizational structures

- Regulatory compliance across multiple jurisdictions

- Need for strategic financial guidance

Understanding your primary audience shapes every decision you make about content, design, and messaging. The website for a solo tax preparer serving freelancers looks fundamentally different from a large CPA firm targeting mid-market businesses.

3. SERP Analysis: What Your Competitors Are Getting Right (And Wrong)

A critical first step in building an authority-level accounting website is understanding what’s already ranking. Our analysis of the top 10 search results for keywords like “accounting firm website design,” “CPA website design best practices,” and “tax professional web design” reveals consistent patterns:

3.1 What Top-Ranking Pages Do Well

Clear value propositions above the fold

Top-ranking sites immediately answer: “Why should I choose you?” They don’t list services; they lead with outcomes. Examples include “Reduce your tax bill by 30% this year” or “Strategic accounting for growing businesses.”

Service-specific landing pages

Rather than a single “Services” page, high-performing sites create dedicated landing pages for each major service (tax preparation, bookkeeping, audit, payroll, etc.). These pages use problem-agitate-solve frameworks and long-tail keywords like “bookkeeping for startups in Austin.”

Trust signals prominently displayed

Certifications (AICPA, EA, state CPA society membership), client testimonials with real results, case studies showing measurable savings, and security badges are visible on every page, not buried in footers.

Mobile-first, fast-loading design

Over 60% of accounting website traffic is mobile. Top sites load in under 2 seconds and feature thumb-friendly navigation with large, tappable CTAs.

Internal linking strategy

High-ranking sites use sophisticated internal linking that connects service pages to relevant blog content, FAQs, and lead magnets, creating a topical authority cluster around core services.

3.2 Content Gaps: What Competitors Miss

Lack of niche-specific messaging

Most accounting websites sound identical. They talk about “expertise,” “reliability,” and “professional service” without showing how they solve specific client problems.

Thin FAQ sections

While competitors include FAQs, few target the actual questions prospects ask. High-intent FAQs include specific queries like “Can I deduct home office expenses?” or “What’s the difference between a 1099 and W2?”

No interactive tools

Few accounting websites include tax calculators, expense trackers, or savings estimators—tools that engage visitors, extend session duration, and capture warm leads.

Weak local Search Engine Optimization(SEO)

Many firms optimize for generic terms nationally instead of targeting high-intent local keywords like “CPA near me” or “tax preparation in [specific neighborhood].”

Missing compliance transparency

While competitors mention data security, few clearly explain GDPR, CCPA, or compliance certifications in simple language that reassures hesitant prospects.

4. The Five Core Elements of a High-Converting Accounting Website

Research and case studies reveal that high-performing accounting websites share five non-negotiable elements. Firms missing even one experience significantly lower conversion rates.

4.1 Crystal-Clear Value Proposition (Above the Fold)

A value proposition tells prospects what’s in it for them—not what you do, but what you solve. This must appear within the first two seconds of landing on your page.

Weak value proposition:

“Comprehensive accounting services for businesses of all sizes”

Strong value proposition:

“Cut your tax bill by 30% while staying audit-proof. Join 200+ local business owners who trust [Firm Name] with strategic accounting.”

The strong version includes:

- A specific, quantifiable outcome (30% tax reduction)

- Social proof (200+ local business owners)

- Reassurance (audit-proof compliance)

- Emotional benefit (strategic partnership vs. transactional service)

Research shows: Firms with clear, outcome-driven value propositions see 50% higher conversion rates than those using generic service descriptions.

4.2 Service-Specific Landing Pages with Problem-Agitate-Solve Copywriting

Instead of lumping all services into a single page, high-converting sites create dedicated landing pages for major service lines. Each page follows the problem-agitate-solve framework:

Example: Tax Preparation Service Page

- Problem: “Navigating self-employment taxes is complex. One missed deduction could cost you thousands.”

- Agitate: “Without a strategic approach, many freelancers overpay by 20-40% in annual taxes.”

- Solve: “[Firm Name]’s tax strategy process identifies every deduction, maximizes credits, and ensures compliance—saving freelancers an average of $5,200 annually.”

Each service page should:

- Include long-tail keywords naturally (e.g., “tax preparation for freelancers in Miami”)

- Feature a client testimonial specific to that service

- Include a downloadable resource (e.g., “Tax Deduction Checklist for Self-Employed”)

- End with a clear CTA (“Schedule Your Free Tax Strategy Call”)

Research shows: Service-specific landing pages outrank generic service pages by 3-5x for niche keywords because they signal specialization and match search intent more precisely.

4.3 Trust-Building Elements Visible on Every Page

Trust is the currency of financial services. Prospects ask themselves: “Can I trust this firm with my money?” Design choice, copywriting, and strategic placement of credibility signals answer this question within seconds.

Essential trust elements:

| Trust Signal | Placement | Example |

|---|---|---|

| AICPA/EA/CPA Certifications | Header/footer, service pages | “Certified Public Accountants serving [City] since 2008” |

| Client Testimonials | Homepage, service pages, sidebar | “We saved $47K in taxes last year. The [Firm] team explained everything clearly.” — Sarah M., Marketing Agency Owner |

| Case Studies | Blog, service pages | “How a Local Restaurant Saved $18K in Payroll Taxes” with metrics and specific results |

| Security Badges | Forms, footer, client portal entry | SSL certificate, GDPR/CCPA compliance icons |

| Review Count & Rating | Google Business Profile, homepage | “4.9/5 stars from 140+ verified Google reviews” |

| Years in Business | Hero section, about page | “Serving [City] for 15+ years” |

| Compliance Certifications | Footer, privacy page | “SOC 2 Type II Certified,” “GLBA Compliant” |

Research shows: Trust signals placed prominently on every page increase lead capture by 25-40% compared to burying them in an “About Us” section.

4.4 Strategic Lead Capture Mechanisms Beyond Simple Contact Forms

While a contact form is necessary, high-converting sites use multiple lead magnets and capture mechanisms to appeal to prospects at different stages of the buyer journey.

Multi-stage lead capture strategy:

Stage 1: Top-of-Funnel (Research Phase)

- Lead magnet: “Tax Deduction Checklist for [Industry]” (downloadable PDF)

- Incentive: Free resource, no commitment

- Placement: Blog posts, homepage sidebar

Stage 2: Mid-Funnel (Evaluation Phase)

- Lead magnet: “Tax Planning Guide for Business Owners”

- Incentive: Gated content, requires email

- Placement: Service pages, dedicated landing page

Stage 3: Bottom-of-Funnel (Decision Phase)

- Lead magnet: “Schedule a Free Tax Strategy Review” (calendar booking)

- Incentive: Direct consultation with principal

- Placement: Exit-intent popup, CTAs on every service page

Key best practices:

- Keep forms short (name, email, phone—that’s it)

- Use exit-intent popups offering free consultations (not aggressive, but strategically timed)

- Tailor lead magnets to each service (Real Estate CPA vs. Startup Accountant)

- Implement automated email sequences immediately after lead capture

Research shows: Multi-stage lead magnets generate 3x more qualified leads than generic contact forms because they address different buyer stages and reduce perceived risk.

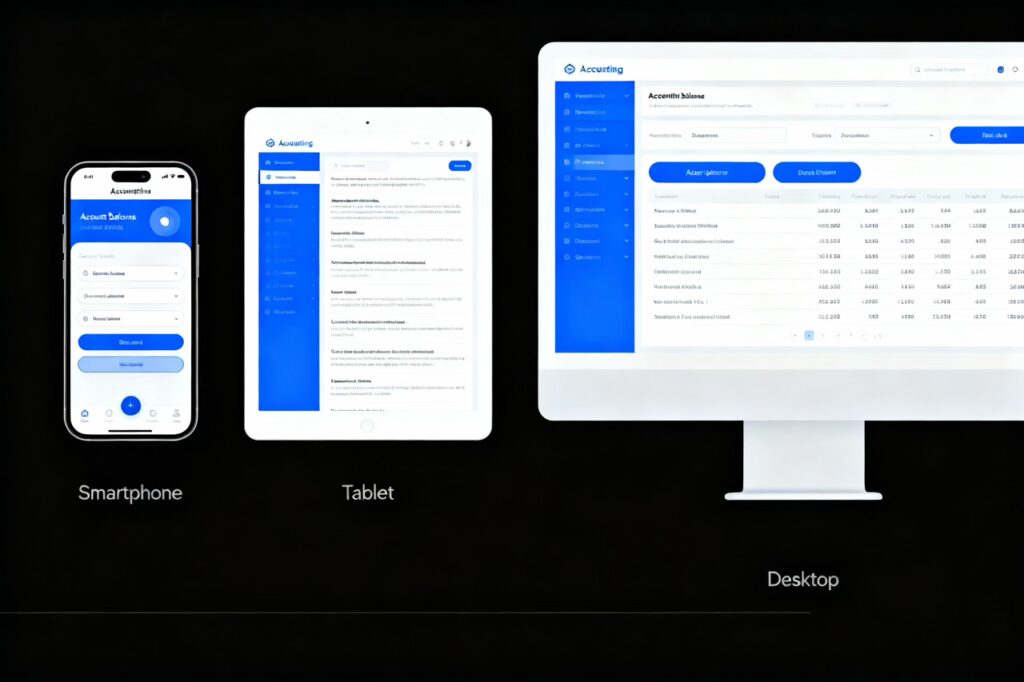

4.5 Mobile-First Design That Actually Works

Over 60% of accounting website traffic is mobile. Yet many accounting firms neglect mobile optimization, leading to high bounce rates and lost leads.

Non-negotiable mobile elements:

- Fast load times: Pages load in under 2 seconds (compress images, minimize code)

- Large, tappable buttons: CTAs are at least 48×48 pixels (thumb-friendly)

- Simplified navigation: Sticky hamburger menu, 4-5 main menu items max

- Readable typography: Minimum 16px font size, high contrast (dark text on light backgrounds)

- Single-column layout: Content flows vertically; forms collapse into mobile-optimized versions

- Click-to-call buttons: “Call Now” buttons on homepage and service pages

- Fast checkout: Lead forms load quickly and don’t require unnecessary fields

Mobile-first responsive design for accounting websites

Real-world example: Clark & Associates revamped their website with lightning-fast AMP (Accelerated Mobile Pages), large tap targets, and sticky call buttons. Result: Mobile conversions increased 34% within three months.

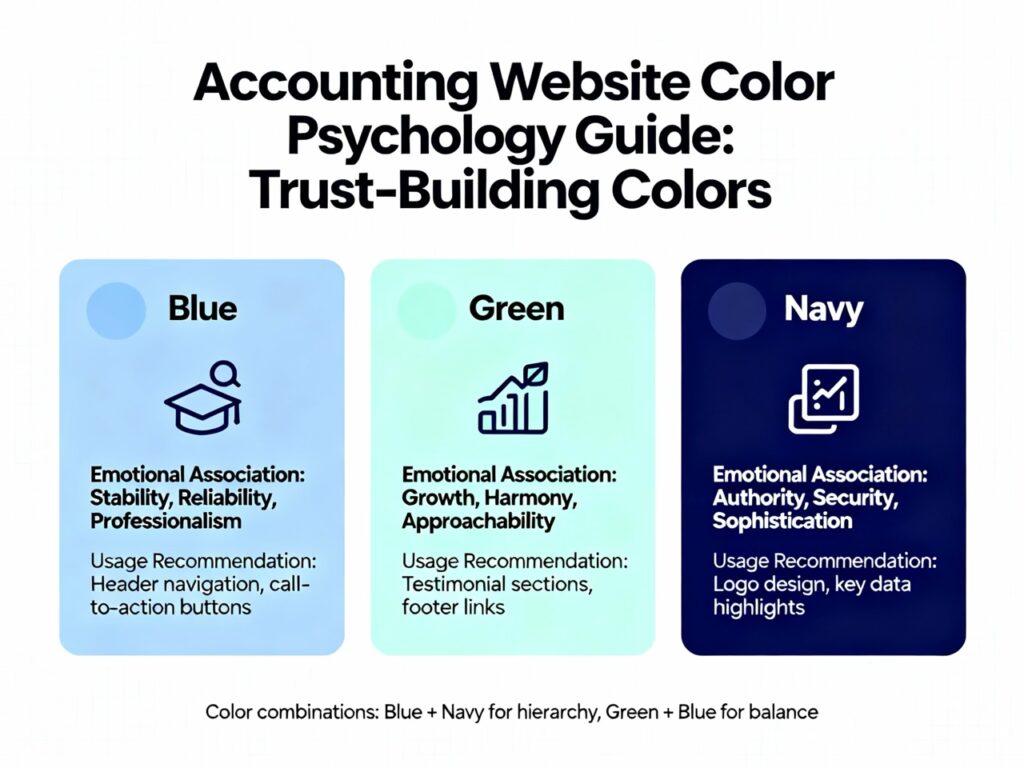

5. Color Psychology and Visual Design: Building Trust Through Design

Research on website color psychology shows that visitors form opinions about websites within 50 milliseconds—and color plays a major role in these snap judgments. For accounting firms, color choice is not aesthetic; it’s strategic.

5.1 Trust-Building Color Palettes

Primary Color: Blue

Blue is the dominant color in professional financial websites for good reason. It communicates:

- Trust and reliability

- Competence and expertise

- Stability and security

- Calm and professionalism

Blue works exceptionally well as a primary color in headers, navigation menus, and buttons. Shades include sky blue (#0066CC), professional navy (#003D82), and slate blue (#336699).

Secondary Color: White or Light Gray

Ensures readability, reduces visual clutter, and creates white space that guides attention to key information.

- Orange: Energetic, action-oriented (works well on blue backgrounds)

- Green: Growth, forward momentum (especially for financial planning services)

- Red: Urgency, attention (use sparingly; can stress clients already anxious about taxes)

Colors to Avoid:

- Bright yellow or purple: Too unconventional for conservative financial services

- Dark backgrounds: Reduce readability and tire visitors’ eyes

- Too many colors: Dilutes brand identity

5.2 Typography and Readability

- Heading font: Clean, modern sans-serif (Helvetica, Roboto, Open Sans)

- Body text: Highly legible sans-serif in 16-18px minimum

- Line height: 1.5-1.8 for comfortable reading

- Character per line: 50-75 characters per line maximum

- Contrast ratio: Minimum 4.5:1 (dark text on light backgrounds)

6. SEO Keyword Strategy: From Research to Implementation

Ranking for high-intent keywords is how accounting websites attract qualified traffic. But not all keywords are created equal.

6.1 Keyword Research for Accounting Services

Types of keywords to target:

Transactional (High-Intent): “CPA for small business,” “tax preparation near me,” “bookkeeping services in [City]”

- Search volume: Moderate to high

- Conversion intent: Very high

- Target: Service pages and homepage

- Audience: Ready to hire

Commercial (Research + Purchase Intent): “Best accounting software for startups,” “How to find a CPA,” “Audit services for nonprofits”

- Search volume: Moderate

- Conversion intent: Medium-high

- Target: Blog posts, FAQ sections

- Audience: In evaluation phase

Informational: “Tax deductions for freelancers,” “How to calculate estimated taxes,” “What is a 1099 form”

- Search volume: High

- Conversion intent: Low (but builds authority)

- Target: Blog, FAQ

- Audience: Early research stage

Local: “CPA in [City],” “[Service] [City],” “Accounting firm near me”

- Search volume: Varies by city

- Conversion intent: Very high

- Target: Google Business Profile, location pages

- Audience: Ready to hire, local preference

6.2 Keyword Research Tools and Sources

- Google Autocomplete: Start typing “CPA for…” or “Tax help…” and note suggestions

- People Also Ask (PAA): Search your primary keyword; PAA boxes reveal real questions prospects ask

- Google Business Profile Insights: If already set up, shows exact search terms driving visitors

- SEO Tools (free): Ubersuggest, Keywords Everywhere

- SEO Tools (paid): Ahrefs, SEMrush, Moz (for deeper keyword difficulty and volume)

- Competitor Analysis: Enter competitors’ URLs into Ahrefs/SEMrush to see what keywords they rank for

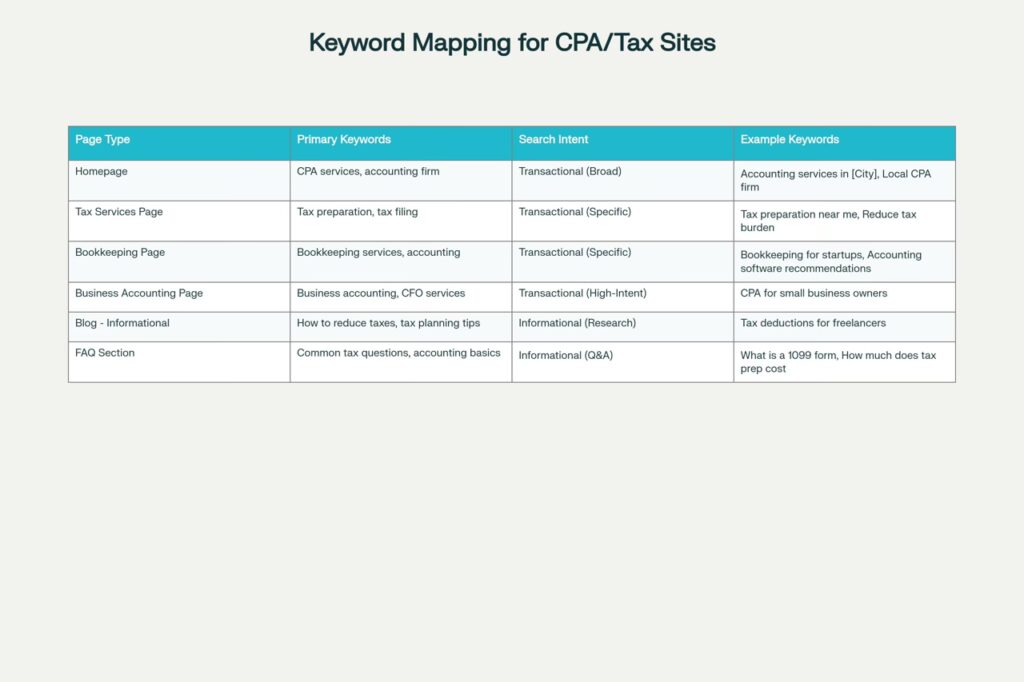

6.3 Keyword Mapping Strategy

Once you’ve identified 30-50 target keywords, map them strategically across your website structure. This ensures each page targets one primary keyword and 2-3 secondary keywords, avoiding keyword cannibalization.

Essential trust signals for accounting website credibility

7. Common Mistakes Accounting Firms Make (And How to Fix Them)

Research reveals a consistent pattern of errors that cost accounting firms clients and revenue:

7.1 Mistake #1: No Clear Target Audience

The Problem: Most accounting websites attempt to serve everyone—individuals, SMEs, large corporations, and multiple industries. This generalist approach dilutes messaging and fails to build deep trust with anyone.

The Result:

- Generic content that doesn’t resonate with specific niches

- Weak SEO performance in competitive markets

- Lost conversions to specialists targeting narrower audiences

The Fix:

- Choose one or two primary target audiences

- Build service pages around specific niches (e.g., “Accounting for Real Estate Investors”)

- Use niche-specific language and case studies

- Tailor messaging to address specific pain points

7.2 Mistake #2: Thin, Generic, or Keyword-Stuffed Content

The Problem: Content that’s too short, uses excessive jargon, or prioritizes keywords over readability fails to attract clients and search engines.

The Result:

- Low search rankings (thin content is penalized by Google)

- Poor trust signals (vague language suggests inexperience)

- High bounce rates (visitors don’t find clear value)

The Fix:

- Develop in-depth service pages (1,500+ words) that address client benefits, not just features

- Use simple language; avoid excessive jargon

- Include specific examples and case studies

- Focus on client problems, not service descriptions

7.3 Mistake #3: Lack of Clear and Compelling CTAs

The Problem: Many accounting firm websites present information but fail to tell visitors what to do next. CTAs are buried, vague, or absent.

The Result:

- Visitors don’t know how to engage

- High bounce rates

- Missed lead opportunities

The Fix:

- Create clear CTAs on every page

- Use action-oriented language: “Schedule a Free Consultation,” “Download Your Tax Deduction Checklist,” “Get a Custom Quote”

- Make CTAs visually distinct (contrasting colors, prominent placement)

- Include CTAs above the fold and at the end of major sections

7.4 Mistake #4: Not Showcasing Social Proof

The Problem: Accounting relies on trust, yet many websites lack compelling evidence of client success—testimonials, case studies, reviews—leaving prospects without validation.

The Result:

- Hesitant prospects who visit competitors instead

- Lower conversion rates

- Loss of brand authority

The Fix:

- Collect and display authentic client testimonials with specific results

- Create 2-3 detailed case studies showing measurable outcomes

- Display Google review counts and ratings prominently

- Include logos of well-known clients (if applicable)

7.5 Mistake #5: Ignoring Mobile Optimization and Load Times

The Problem: Over 60% of accounting website traffic is mobile, yet many sites aren’t optimized for smartphones. Slow load times (over 3 seconds) cause 53% of visitors to abandon.

The Result:

- High bounce rates on mobile

- Lower search rankings (Google prioritizes mobile-first)

- Lost leads from mobile users

The Fix:

- Compress images using WebP format

- Implement lazy loading

- Use Content Delivery Networks (CDNs) for faster global delivery

- Test on real devices (iPhone, Android) using mobile device labs

- Aim for load times under 2 seconds

7.6 Mistake #6: Using Templated Websites with Duplicate Content

The Problem: While templated websites (Thomson Reuters, CPA Site Solutions) seem cost-effective, they use the same duplicate content across all clients, harming SEO and failing to differentiate.

The Result:

- Duplicate content penalties from Google

- Weak brand differentiation

- Poor SEO performance

- Loss of trust (prospects recognize the template)

The Fix:

- Invest in custom or semi-custom website design

- Create unique, original content specific to your firm and niche

- Avoid platform templates that serve dozens of competitors

8. Compliance and Trust: The Regulatory Landscape for Financial Professionals

Building trust isn’t just about design and messaging; it’s about compliance. Financial professionals must navigate complex regulations that directly impact website design, content, and data handling.

8.1 Key Regulatory Requirements

| Regulation | Focus Area | Key Requirement | Risk of Non-Compliance |

|---|---|---|---|

| ADA (Accessibility) | Website accessibility | Screen reader compatibility, color contrast 4.5:1, keyboard navigation | Lawsuits; accessibility fines average $350,000 |

| SEC Marketing Rule | Financial claims | Performance data with net/gross returns; testimonials require disclaimers | Regulatory scrutiny, penalties for misleading claims |

| FINRA (if applicable) | Communication standards | Fair, balanced, not misleading; all claims substantiated | Regulatory fines, loss of trust |

| GDPR | Data protection (if serving EU clients) | Explicit consent for data collection; secure storage; breach notifications | Fines up to 4% of global turnover |

| CCPA (if serving CA residents) | Privacy | Clear data collection practices; breach notifications within 30 days | Fines up to $7,500 per violation |

| GLBA | Financial data protection | Secure handling of client financial information | Regulatory penalties, reputation damage |

8.2 Practical Compliance Checklist

On-Site Trust Signals:

- ✓ Clear privacy policy (linked on every page)

- ✓ GDPR/CCPA compliance notice (if applicable)

- ✓ SSL certificate (HTTPS on all pages)

- ✓ Data security badges (SOC 2, etc.)

- ✓ Disclaimers on performance claims

Content Compliance:

- ✓ All performance data substantiated

- ✓ Testimonials include disclaimers

- ✓ No guaranteed results or promises

- ✓ Clear explanation of firm credentials

- ✓ Archive of all website changes for audit trails

Technical Security:

- ✓ Encrypted forms for sensitive data

- ✓ Regular security audits

- ✓ Data backup and disaster recovery plan

- ✓ Access controls for client data

9. The Devbo Approach: How Premium Web Design Agencies Build Accounting Websites That Rank and Convert

High-performing accounting websites aren’t built by accident. They’re the result of systematic methodology combining SEO expertise, conversion optimization, and deep industry knowledge.

9.1 Discovery and Strategy

Before design begins, top agencies conduct:

- SERP analysis for target keywords (top 10 competitors)

- Competitive positioning audit (what makes you different?)

- Audience persona development (who are we speaking to?)

- Keyword research and mapping (what search terms matter?)

- Conversion goal setting (lead capture, consultations, specific revenue targets)

This discovery phase ensures the website aligns with business objectives, not just aesthetic preferences.

9.2 Content Strategy and Information Architecture

High-converting accounting websites organize content strategically:

- Homepage: Clear value prop, trust signals, broad service overview, primary CTA

- Service Pages: Problem-agitate-solve copywriting, long-tail keywords, case studies, specific CTAs

- Blog/Resource Center: Informational content addressing prospect questions, building topical authority

- FAQ Section: Targeting PAA questions, addressing objections, providing quick answers

- About Page: Founder bios with credentials, firm values, years in business

- Contact/Consultation Page: Multiple lead capture options (form, calendar, phone)

This structure guides prospects through a logical journey from awareness to decision.

9.3 Design and User Experience

Agencies focused on results prioritize:

- Visual hierarchy: Important information stands out

- Color psychology: Trust-building color schemes aligned with brand

- Navigation clarity: Users find what they need in 2-3 clicks

- Mobile optimization: Responsive design tested on real devices

- Load speed: Images compressed, code optimized, CDN implemented

- Accessibility: WCAG 2.1 AA compliance ensures inclusivity

9.4 Conversion Optimization

Beyond beautiful design, top agencies implement:

- A/B testing: Headline, CTA, color variations tested against baselines

- Heatmapping: Understanding where users click, scroll, and abandon

- Form optimization: Minimal fields, clear value proposition, automated follow-up

- Exit-intent tactics: Popups offering lead magnets before users leave

- Call tracking: Unique phone numbers per traffic source

- Analytics and reporting: Monthly reviews of traffic, conversion rates, lead quality

9.5 SEO Integration

SEO isn’t an afterthought; it’s baked into the entire website:

- Keyword optimization: Primary and secondary keywords in titles, headers, content

- Technical SEO: Fast loading, mobile-first, structured data (Schema markup), sitemap

- Internal linking: Strategic links between related content

- Local SEO: Google Business Profile optimization, location pages for multi-location firms

- Content freshness: Regular blog updates signaling active maintenance

- Backlink strategy: Earning links from industry publications, local directories

10. Frequently Asked Questions: What Accounting Professionals Ask

What’s the most important feature for an accounting firm website?

A clear, outcome-driven value proposition above the fold. Prospects need to know immediately why they should choose you and what’s in it for them. Generic claims like “reliable accounting services” don’t cut it; specific outcomes like “reduce your tax bill by 30%” do.

How long should an accounting website take to load?

Under 2 seconds on desktop, under 3 seconds on mobile. Anything slower causes 50%+ of visitors to abandon. Use Google PageSpeed Insights to measure; Google Lighthouse is the gold standard.

Should we include testimonials from clients if we have confidentiality concerns?

Absolutely. Use clients’ permission and ask for testimonials that don’t disclose specific financial figures or sensitive details. Format: “Firm Name helped us achieve [outcome]” or “Our tax bill was reduced by X%.” This builds trust without violating confidentiality.

How many service pages should we create?

Create a dedicated page for each major service offering (tax preparation, bookkeeping, audit, payroll, etc.). For niches, create additional pages (e.g., “Accounting for Real Estate Investors,” “Tax Planning for Medical Practices”). Aim for 8-15 service pages total.

What keywords should we prioritize first?

Start with local, transactional keywords with buyer intent: “CPA in [your city],” “[service] [city],” “tax help [city].” These have lower competition and highest conversion intent. Once you rank for these, expand to broader terms and informational content.

How often should we update website content?

At minimum, update blog content monthly (2-4 new posts). Quarterly content audits ensure old information is refreshed or removed. This signals to Google that your site is actively maintained.

Should we have a client portal on our website?

Yes. A dedicated client portal (integrated or linked) significantly improves client experience and retention. Clients expect 24/7 access to documents, tax forms, and communication. Portals also reduce support requests and improve client satisfaction scores.

What’s a realistic timeline to see SEO results?

3-6 months for local keywords (easier to rank for), 6-12 months for broader industry keywords (more competitive). Results depend on keyword difficulty, existing domain authority, and content quality. Avoid anyone promising results in 30-90 days.

How much should an accounting firm website cost?

Custom websites for accounting firms typically range from $10,000–$50,000+ depending on complexity, features (client portal, CRM integration), and agency expertise. Premium agency websites start at $25,000–$75,000. This is an investment that typically pays back in 6-12 months through new client acquisition.

Do we need to update our website annually?

At minimum, audit and refresh annually. Update testimonials, case studies, pricing, compliance notices, and outdated language. Redesigns (full or partial) are recommended every 2-3 years to stay current with design trends and technology.

11. Recommended Internal Linking Strategy and Content Clusters

High-authority accounting websites use strategic internal linking to build topical clusters around core services. This signals to Google that you have deep expertise in specific areas.

Example Cluster: Tax Planning for Business Owners

Pillar Content (Main Authority Page):

- “Business Tax Planning Guide for Entrepreneurs”

Cluster Posts (Supporting Content):

- “Tax Deductions Every Small Business Should Know”

- “How to Maximize Your 401k as a Business Owner”

- “Tax Planning for Multi-State Business Operations”

- “Common Tax Mistakes Business Owners Make”

- “Quarterly Tax Payments: Everything You Need to Know”

Internal Linking:

- Pillar page links to each cluster post

- Each cluster post links back to pillar page

- Related cluster posts link to each other

- CTAs at end of each post direct to consultation booking

This structure tells search engines: “This site has comprehensive expertise in business tax planning.”

12. Keyword List: High-Intent Keywords by Service

Tax Preparation Services

- Tax preparation near me

- Tax prep services [city]

- CPA tax preparation

- Business tax preparation

- Self-employed tax help

- 1099 tax services

- Estimated quarterly taxes

- Tax planning for small business

Bookkeeping Services

- Bookkeeping services [city]

- Virtual bookkeeper

- Bookkeeping for small business

- QuickBooks accounting services

- Monthly bookkeeping

- Bookkeeping for contractors

- Nonprofit bookkeeping services

Accounting Services

- Accountant near me

- CPA services [city]

- Small business accounting

- Business accounting services

- CFO services

- Financial accounting support

- Virtual CFO services

Audit & Compliance

- Audit services [city]

- CPA audit

- Nonprofit audit services

- Financial statement audit

- Compilation services

- Audit preparation

Niche-Specific (Examples)

- Accounting for real estate investors

- CPA for medical practices

- Accounting for dental offices

- Bookkeeping for restaurants

- Tax planning for nonprofits

- CPA for ecommerce businesses

13. Suggested Blog Post Clusters to Build Topical Authority

To establish authority in accounting and tax services, create interconnected blog post clusters around these core topics:

- Tax Planning & Deductions Cluster (8-10 posts)

- Starting pillar: “Complete Tax Deduction Guide for [Your Primary Niche]”

- Supporting: specific deduction types, seasonal tax planning, industry deductions

- Small Business Accounting Cluster (8-10 posts)

- Starting pillar: “Accounting Fundamentals for Small Business Owners”

- Supporting: cash flow management, profit tracking, payroll basics

- Compliance & Regulatory Cluster (6-8 posts)

- Starting pillar: “Stay Audit-Ready: Accounting Compliance Checklist”

- Supporting: payroll compliance, 1099 requirements, entity structure compliance

- Industry-Specific Clusters (varies by niche)

- Example for real estate: “Real Estate Accounting Guide” with supporting posts on depreciation, rental income, property deductions

- Financial Planning Cluster (6-8 posts)

- Starting pillar: “Strategic Financial Planning for Business Owners”

- Supporting: retirement planning, cash reserve strategies, year-end tax planning

14. Visual Design Specifications for Devbo Accounting Websites

When building accounting websites at Devbo, follow these design specifications to ensure consistency, trust, and high conversion:

Color Palette

- Primary: Navy Blue (#002B5C) or Professional Blue (#0066CC)

- Secondary: White (#FFFFFF) or Light Gray (#F5F5F5)

- Accent 1 (CTAs): Orange (#FF8C00) or Green (#2B8C41)

- Accent 2 (Alerts/Warnings): Red (#DC3545)

- Text: Dark Gray (#333333) on light backgrounds

Typography

- Headers: San-serif (Roboto, Helvetica, Open Sans) – Bold, 32-48px

- Subheaders: San-serif – Semi-bold, 24-32px

- Body Text: San-serif – Regular, 16-18px

- Line Height: 1.6

Button Specifications

- Primary CTA: Contrasting color (orange on blue), 48px minimum height, 16px text

- Secondary CTA: Outlined style, 40px height

- Hover State: Slight color shift, subtle shadow

Spacing

- Hero Section: 60-80px padding vertical, 40px horizontal

- Section Spacing: 80-120px between major sections

- Card Spacing: 20-30px padding internal

15. Your Next Step

At Devbo in Clearwater, FL, we specialize in building authority-level websites for tax, accounting, and financial services professionals nationwide. Our process combines deep SERP research, conversion-focused design, SEO best practices, and continuous optimization to attract qualified leads and build your firm’s online authority.

If your current website:

- Doesn’t rank for high-intent keywords

- Fails to convert visitors into leads

- Looks outdated or lacks trust signals

- Isn’t optimized for mobile

- Doesn’t reflect your firm’s niche expertise

It’s time for an upgrade.

Let’s conduct a free website audit and show you exactly what’s costing you leads and revenue. Schedule a consultation with our team to discuss your firm’s specific needs.

Conclusion

The accounting industry has changed. Firms no longer compete on Yellow Pages listings or banker referrals. They compete online—on search engines, on Google Business Profiles, on their websites.

A high-performing accounting website does three things simultaneously: it builds trust through design and messaging, attracts qualified traffic through SEO, and converts visitors into leads through strategic calls-to-action and friction-free navigation.

Your website is your most powerful sales tool. Make sure it’s working as hard as you are.